Tips and tools for social media. While building up your content will require time and money, you can produce high-quality material with a smartphone and a few simple tools and tips. The main advantage of using social media is that it’s an inexpensive method of raising brand exposure.

Additionally, you might be able to reach your target audience on social media for a lot less money than you would with targeted advertisements.

Social media can be used to achieve a variety of goals, including brand development, credibility building, word-of-mouth marketing, and tightening ties with current clients. Alternatively, you may merely want to use social media to direct visitors to your website, where they may end up becoming paying clients. Remember to communicate with your followers on social media in addition to posting. If someone shows interest in your brand, be there, engage, and interact. Below are some tips and tools for social media success.

Be consistent.

Being consistent is the best thing you can do as a small business when you first start using social media. Too frequently, brands lose faith if they don’t start seeing results right away. Social media growth might be gradual, but like with other things, if you are persistent, you will see benefits. This entails regularly publishing content of a high caliber (at least once a week). There are several reasons why you do this.

The first is that you want users to have a clear understanding of your brand when they do land on your profile. Users will quickly lose interest and leave if your website contains little to no content. For scattered posts, the same is true.

You can share a story on social media. Users will understand what to expect from your page, what your voice is like, and what you have to offer when consistency and coherence are given priority. And in doing so, you’ll draw in your target segment.

Add variety to your content.

There is so much possibility for experimentation and creativity on social media. All too often, businesses adopt a single successful strategy.

Social media is continuously changing and evolving. Due to the addition of new features and shifting user habits on various platforms, what worked yesterday might not work today.

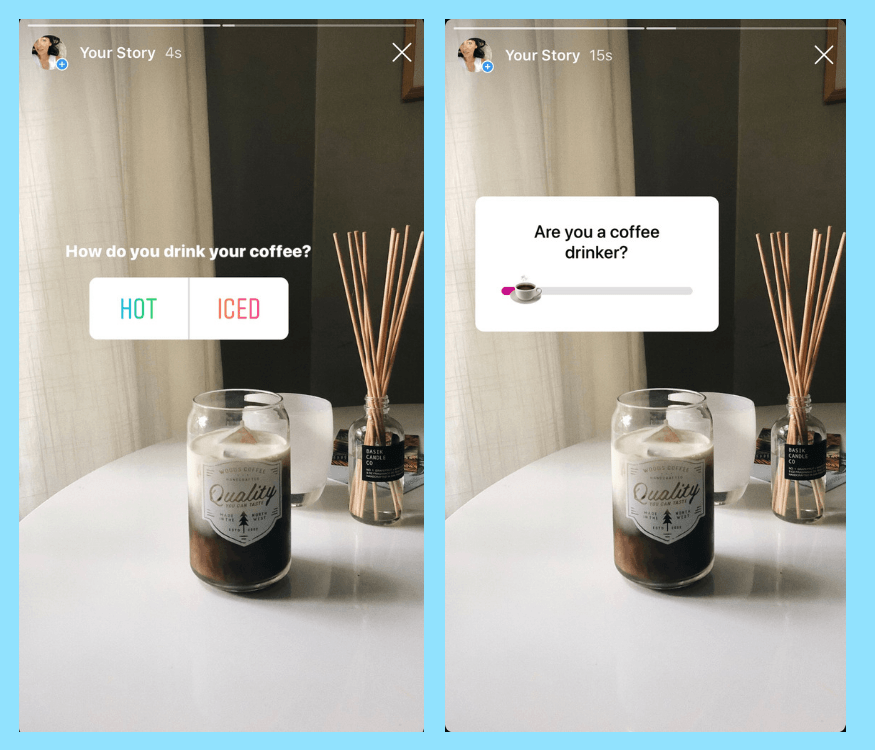

Keeping this in mind, experiment as much as you can with content types. For instance, you can only post videos on TikTok. On Facebook, though, you have the choice to go live, post pictures, run polls, and more.

For small businesses, the simplest approach for them to build their audience and grow their following is to create educational and/or compelling material.

We are not saying that small businesses should limit themselves to these two forms of content. They ought to experiment with all their content in order to determine what their audience prefers. However, this can be a good place to start.

Here are some suggestions to get you going:

- Customer spotlights

- How-to’s

- Behind the scenes

- Trends (viral sounds and dances)

- Product features

- Q&As

- Facts about your industry

Quality over quantity.

This is true for both the platforms you use and the content you post. While posting frequently on social media is welcomed from a content standpoint, there is a catch. Your posts must all add value. If it doesn’t fit that description, think about a different tactic, such as sharing user-generated content or reposting brand-related content from a non-competitor.

Platforms.

A small business may not have the time or money to maintain an account on every social media network. Concentrate on one to three platforms that have the demographics of your target audience, and then move forward from there.