PME funded business Main & Local talks about their experience with mentors.

There comes a time in every entrepreneur’s career when they are unable to make a decision or simply don’t know what to do, and require a certain amount of guidance. Asking for guidance is perfectly normal, but you must make sure you ask the right people. That is where mentors come in: a mentor is a successful professional that has experience in your industry, and helps your start-up by providing counseling and guidance.

Why do I need a mentor?

Getting a mentor can help you avoid some failure and will significantly shorten your learning curve: if you are unsure about which direction to take, you can ask your mentor instead of trying to do it yourself, and possibly doing it wrong. A mentor will also guide you. Sure, you are your own boss, but you still have to deal with investors, customers, and suppliers, so having a relationship with a mentor will increase your circle of confidants. Being an entrepreneur can also get quite exhausting emotionally and mentally: when you need support, you will always be able to turn to your mentor. If you are too emotionally invested in your start-up and can’t see things objectively, your mentor will be able to provide you with a fresh perspective.

Where can I find a mentor?

Note that some mentors work for free, under a volunteer model. Here are some examples of organizations that can help you find a free mentor:

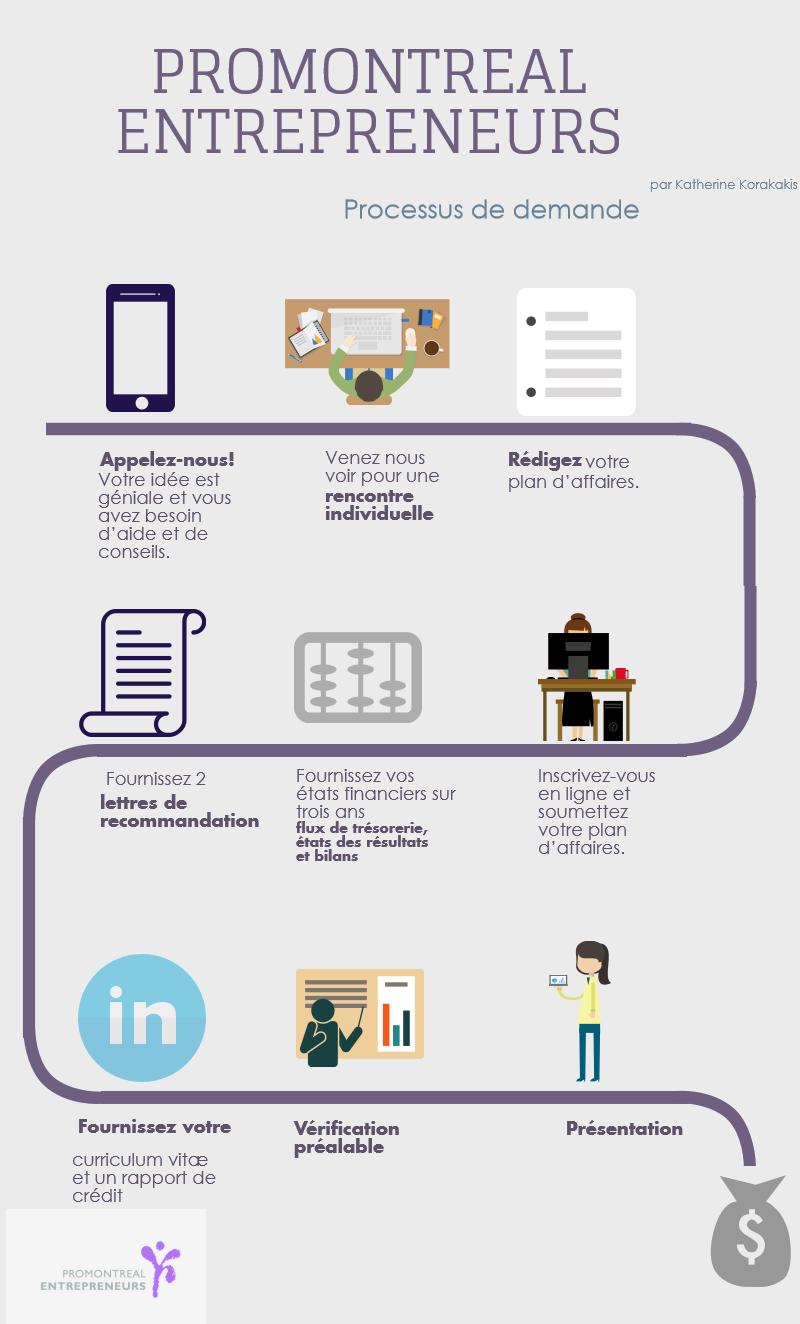

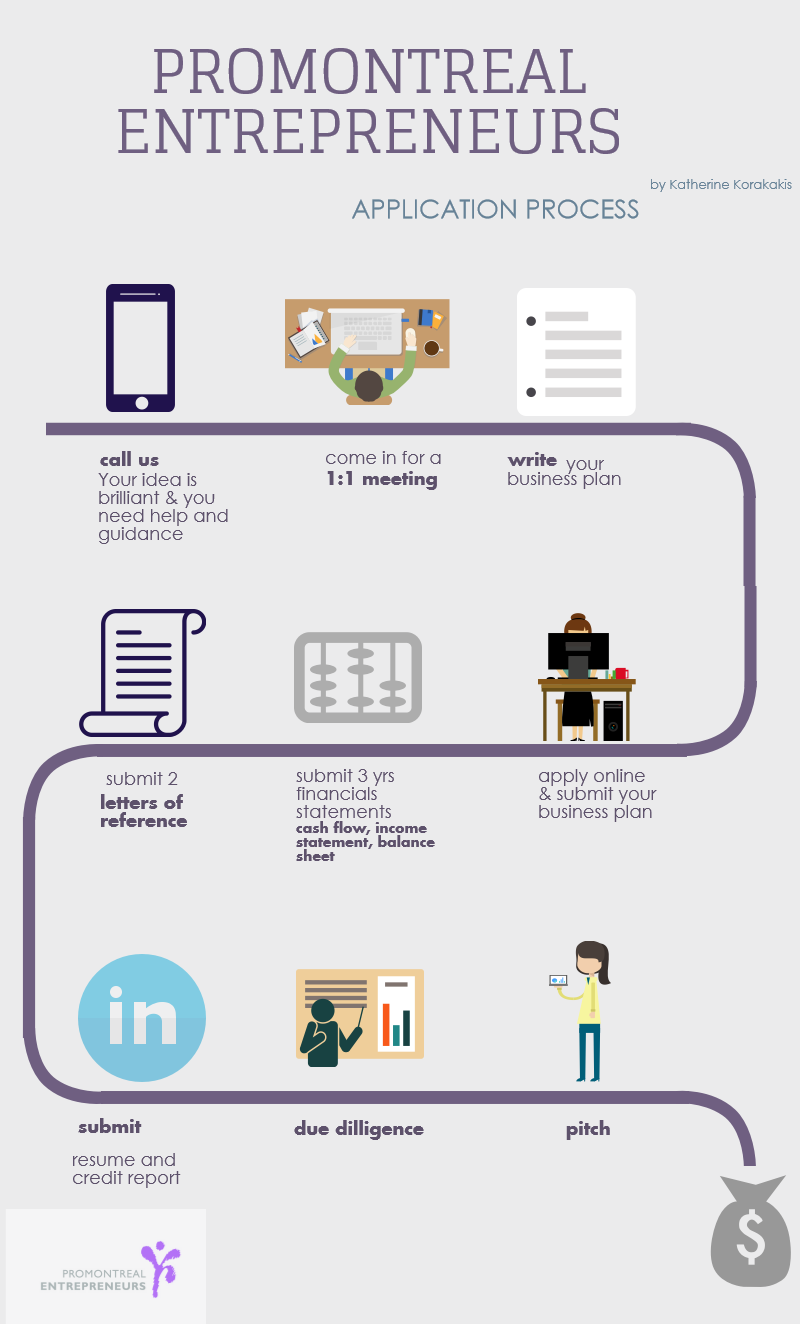

- ProMontreal Entrepreneurs: we match our mentor’s experiences to the needs of our mentees, and forge long-lasting relationships.

- Yes Montreal: To apply to this mentorship program, you must be referred by a business coach. Yes Montreal mentorship provides entrepreneurs with a continuous mentorship relation for at least a year.

Other mentors require money for their services. The argument here is that mentors who have a monetary incentive are able to give better advice, and have better connections that they can introduce you to. Again, here are a couple of mentorship programs that function according to the paid model:

- Highline: this organization offers a paid package where entrepreneurs can benefit from office space, mobile education, and access to a variety of mentors.

- DreamIT: DreamIT is an accelerator that offers 3 to 4 month programs that include funding, training, and mentorship for experts across the United States.

I want to be a mentor. What’s in it for me?

Above all, there is the altruistic experience of helping a young entrepreneur seeking guidance and sharing your knowledge. Although this is a little cliché, changing an entrepreneur’s life can very well make your own life better. Furthermore, you never know where the relationship will take you: you might be pleasantly surprised. Many times mentors learn as much as the mentees do!

Apart from benefiting your own karma, mentoring will also benefit your career. Mentors are seen as more respected, knowledgeable professionals. You will improve your reputation in the business world, and will likely make new contacts that may be able to help you in the future.

Sounds tempting, right? If you are interested in becoming a mentor, why not consider ProMontreal Entrepreneurs. Our simple online application will get you mentoring young entrepreneurs in no time.